On 8th May 2020, the Australian Bankers Association reported that the total number of home loan repayment deferrals by Australian banks was approximately 392,000 which is around 6.2% of all bank home loans. With many of these deferrals for a period of six months, dealing with the recovery of these loans will be a major challenge confronting lenders and borrowers over the next couple of years.

The options available will depend on how much a borrower can afford (and is willing to make). Having experienced financial difficulties due to the COVID-19 environment, it is expected that many borrowers will want to contract to the minimum possible repayment amount so they can ensure they have a sufficient buffer to cater for potential future financial bumps and hurdles. There will probably be a greater desire of borrowers to use offset facilities so they can be sure of having ready access to funds when needed (particularly those aware of the some of the redraw problems).

The solution for individual borrowers will vary depending on their post-COVID financial circumstance and the pre-COVID position of their loan. It was somewhat surprising to see in the bank’s public disclosure of COVID repayment deferrals, that a large proportion of requests were from borrowers with very low LVR.

While not reported specifically by lenders, anecdotally, there also appears to be many requests from borrowers who are well in advance of contracted repayment schedule or with high offset balances.

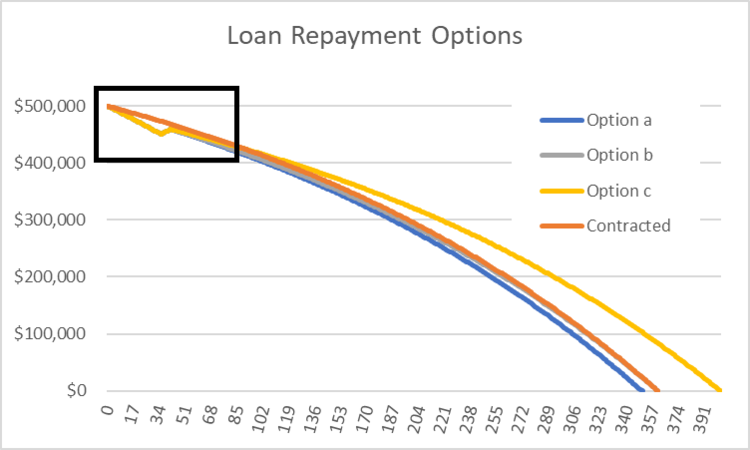

In cases where the borrower regains employment at an income similar to their pre-COVID level, there are three typical options that a lender can consider. Depending on the customer’s financial circumstances at the end of the deferral period, the lender could consider:

a) Increasing repayments from the original contract so that the loan will pay out within the original term (will usually mean that repayments will increase by around 3%);

b) Allowing the borrower to continue to make the repayment amount that was originally contracted and extend the term of the loan (depending on circumstances, this could increase the loan term by around 2 years);

c) Restructuring the loan to a new term of 30 years (depending on the age of the original loan, usually the repayment amount will be lower than the original contracted repayment).

Below is an example based on a $500,000 loan over 30 years at an interest rate of 4% which is 3 years into its term when repayments are deferred for six months with two common scenarios

1. A borrower who is making repayments in accordance with the contract

2. A borrower making repayments more than the contracted repayments

The three categories of recovery from home loan repayment deferrals that we have described would result in a relatively smooth transition out of COVID-19 with minimal forced sales or bank losses.

However, at this stage it is difficult to determine the proportion of the 392,000 payment deferrals that meet the “smooth transition” criteria. If the LVR distribution and anecdotal evidence of repayments in advance is a guide, then the proportion could be as high at 80%. The issue is then around how many of these borrowers get back to an income that is reasonably consistent with their pre-COVID level.

Information published by the Grattan Institute (Shutdown: estimating the COVID-19 employment shock 2020) provides some good analysis to estimate the impact on consumers according to industry type, income bad, age and gender. Correlating this information to characteristics of borrowers with home loan repayment deferrals could provide lenders with a reasonable estimate of the volume of borrowers that meet our “smooth transition” criteria and the size of the “vulnerable” borrower cohort.

Borrowers “vulnerable” cohort may require more innovative solutions which will be highly dependent on the movement in house prices, the level of unemployment and the willingness of lenders to avoid a forced sale. Experience from the US mortgage crisis of 2008-09 has demonstrated the potential adverse consequences on consumers and the economy if these issues are not given careful consideration.

Written by Steve Johnson, cofounder of Kadre, former chairman and CEO of ARCA, former NAB Global Head of Retail Credit and advisor to the retail credit industry.