Kadre Article Series – Perspectives on Credit and Risk in Australian Financial Services

Welcome to Kadre’s – article series ‘Perspective on Credit and Risk in Australian Financial Services’ where, the Kadre team will provide leading commentary, reflecting on their collective experience, to help Chief Risk Officers navigate the permanent white water of the Australian Financial Services environment.

How should lenders prepare for the possibility of increasing stress in credit card portfolios?

In this article we’ll dig into some of the credit card numbers, investigate what they may be hiding, take a closer look at the external economic environment and advise on what lenders can do to mitigate credit card risk in the near future.

Credit Card market

Credit card popularity in Australia has been diminishing for some time with the number of personal credit and charge card accounts on the decline for several years since 2017. Some of this can be attributed to a heightened fear of debt and associated interest and fees, particularly amongst younger generations which in turn, has led to a higher uptake of debit cards.

Other contributing factors such as annual fees, a decline in the value of rewards programs and increased competition from ‘near prime lenders’ offering good rates, have all played a part in the declining credit card popularity stakes. Meanwhile the emergence of Buy-now-pay-later (BNPL), online shopping and digital wallets has opened a whole new world of buying, with consumers having a wide variety of payment options now available to them.

Accelerating this trend, the Covid pandemic saw dramatic changes in income and expenses for various cohorts of the population which resulted in a shift in the spending and saving behaviour of consumers. Many people became ‘cashed up’ during the lockdowns, saving money and paying off debts.

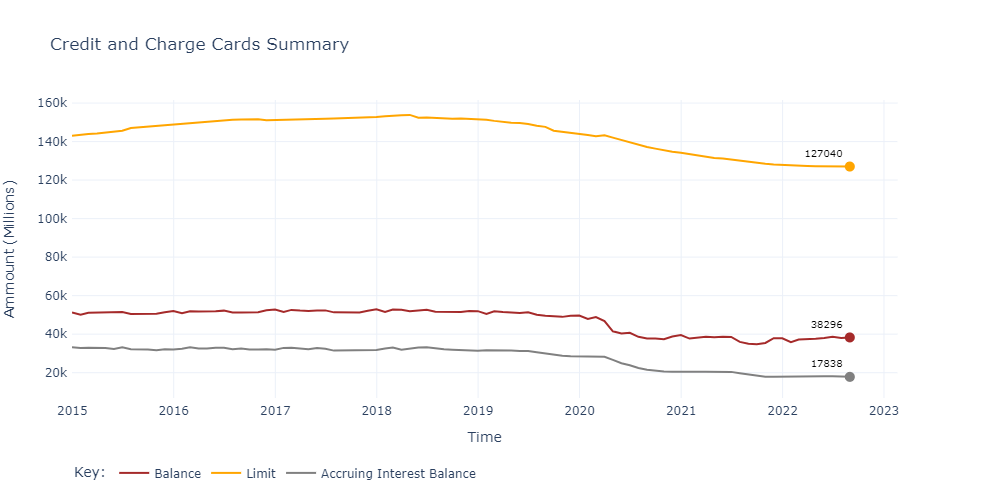

From March 2020 to June 2020 Australians wiped a staggering $4.2 billion dollars off the national credit card debt accruing interest as the COVID pandemic hit. Furthermore, according to figures released by the RBA, credit card balances have significantly declined since 2020, having dropped by as much as $10B, a 21.7% decrease. Coming off strong economic conditions for over a decade, these behavioural changes have sent credit card arrears rates to all time low levels, painting a, seemingly, rather rosy picture for lenders in terms of credit risk.

However, recent figures show this decline in credit card use has been arrested – the curve has flattened. And despite the decrease in credit card use over several years, as many as 62% of Australians currently have a credit card and 1 in 4 are looking to apply for one in the next 12 months.

Credit and Charge Cards Summary

Credit Card Risk and Exposures

Kadre monitors arrears trends across the industry using annual reports, prudential disclosures, and other public information and no signs of credit card stress are evident in the figures to date.

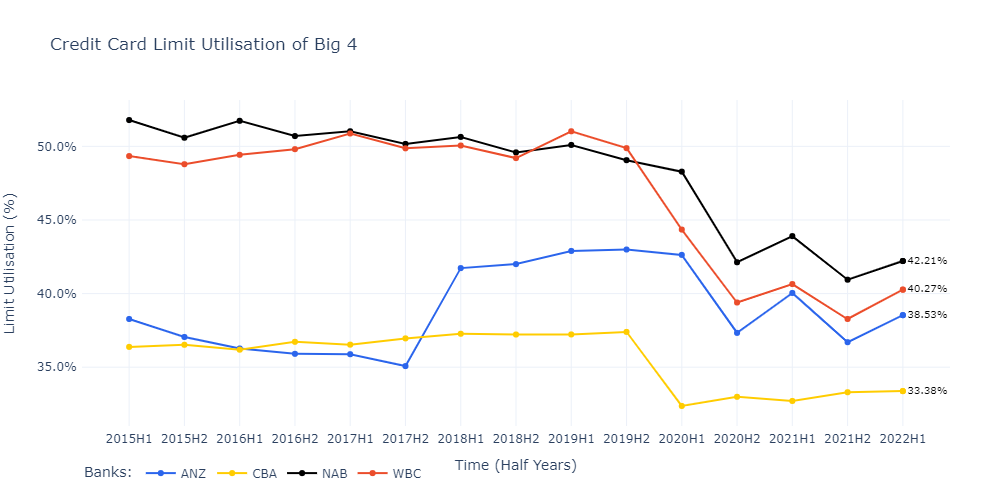

Analysis of Big 4 credit card portfolios reveals some of the lowest impairment rate distributions seen over the last seven years, with rates steadily decreasing since 2020 and landing between 0.21% to 0.39% in the most recent half.

These figures suggest that that many consumers took advantage of high net surplus income (primarily due to lower spending) over the COVID period to pay down their credit card debt. Overall, the aggregate data shows that the net result is that Covid has created a significant increase in the “open to buy” (unused limits) credit available to card holders, rising from 65% to 70% – the largest percentage increase since the 1990’s. Also reflected in Big 4 portfolios below.

What is not evident from the data is the concentration of available limits across various customer cohorts and profiles. This is particularly concerning as we enter a period of higher inflation, higher interest rates, and lower wages growth, and customer segmentation becomes more important.

Traditionally, we tried to distinguish “transactors” from “revolvers” as a way of understanding different cohorts of customers and the type of risks they presented in credit card portfolios. In today’s environment, segmentation of credit card customers is more complex but remains a vital ingredient to effective management of these portfolios.

This creates a contingent liability for lenders, and a key area of portfolio analysis.

Inflationary pressures, household debt and average credit card purchases

Inflation marches on, owing to continued global supply related issues and domestic monetary policy, which has resulted in sharp interest rate hikes for Australian consumers.

ABS data shows CPI increasing 7.3% year on year in the September 22 quarter and household debt to disposable income has been steadily increasing since March 2021.

Looking for signs of inflation, analysis of RBA’s payment data reveals that average credit card purchases are up 4.3% and average balances have grown 9.7% year on year.

Whilst interest-bearing balances were on a downwards trend, the latest figures show a leveling off which may indicate that more people are turning to credit than before. Potentially heightening future risk for certain cohorts of customers.

These indicators paint a potential affordability problem for consumers, one that is expected to get worse as interest rates continue to increase with essential goods and services as inflationary pressures continue.

The effect of Buy-Now-Pay-Later

There is also a new risk that needs to be considered by credit card providers – the impact of Buy-Now-Pay-Later.

Finder’s Future of Credit Cards Report 2022 asserts that as many as 1 in 3 Australians now use a digital wallet and 55% of Gen Z Australians have used BNPL in the last 6 months.

A recent study by University of Sydney and Experian estimates 1 in 4 adults to actively use BNPL, with users either using their credit card or debit card to pay installments.

Crucially, the study indicates that customers with a BNPL and a Credit Card, where the BNPL was repaid from a debit card account, were 4 times more likely to fall 60+ DPD on their credit card repayments.

With such an added differential risk profile, without appropriate monitoring, it poses a significant and unknown exposure for portfolio managers.

So how should Credit Card lenders prepare for the possibility of increasing repayment stress?

Given there is a contingent risk evidenced by a huge open to buy, credit card balances no longer in decline, the added effect of BNPL, and an uncertain economic environment, lenders should start thinking about strategies to minimise exposure to risk, and to review and reinforce their corporate responsibility programs.

This starts with analysis of portfolios to assess signs of early financial stress at an account level, followed by segmenting portfolios accordingly for different treatment paths.

Early indicators of stress:

- Transaction data for usage of BNPL’s, if you’ve got it – look for BNPL fees or dishonours and payments to multiple BNPL providers that could indicate BNPL stress

- Sharply increasing balances and arrears

- Missed payments on other products

- Increase in DPD

- Rapid utilisation increase on a credit card

- Material increases in risk as shown by bureau alerts – such alerts won’t include information on BNPL’s but will be able to alert on other missed payments

- Change in customers circumstance that could indicate potential financial stress: unemployment, illness, divorce

- Increased Cash Advances on credit cards or utilisation of Overdraft limits on transaction accounts

- Rapidly reduced savings

Once the vulnerable pockets of customers have been identified, then you can consider the 6 following treatment paths:

- Credit limit decreases

- Customer contact to build engagement and recognise any early signs of financial stress

- Establishing or re-establishing criteria for bureau alerts

- Adjusting collections strategies based on propensity to pay

- Pre delinquency actions

- Removal from credit promotional campaigns

The key takeaway is that whilst there is no current evidence of portfolio level credit card stress, interest accruing balances are no longer declining and so in today’s volatile economic environment banks need to prepare for a rise in credit card defaults. Only time will tell the extent of credit card stress. But by taking action now, assessing early indicators of stress and implementing appropriate treatment paths, you can reduce the impact of the impending bounceback in credit card delinquency.

Contributors:

Kadre is a specialist credit risk and data science consultancy, solving meaningful problems for Chief Risk Officers and Mortgage Portfolio Managers within Banks and other large organisations.

For further advice or to organise a chat, feel free to reach out to mike@kadre.com.au or t@kadre.com.au